How does TurboTax simplify the tax filing process for individuals

TurboTax’s Transformative Role in Simplifying the Tax Declaration Journey

Navigating the intricate web of tax regulations and computations can be a formidable challenge for individuals during the tax season. However, TurboTax, a leading tax preparation software, emerges as a transformative tool that significantly simplifies the entire tax declaration process. In this exploration, we will delve into the multifaceted ways in which TurboTax streamlines and simplifies the tax-filing experience for individuals, providing not only a software solution but a comprehensive and user-friendly guide through the often complex terrain of tax preparation.

Navigating Taxes with TurboTax’s Intuitive and User-Friendly Interface

TurboTax’s strength lies in its intuitively designed and user-friendly interface. Recognizing that not all users are tax experts, the platform presents intricate tax-related jargon and calculations in a digestible and accessible manner. Whether you are a seasoned taxpayer or a first-timer facing the IRS labyrinth, TurboTax’s clean design and straightforward layout guide users seamlessly through each step, eliminating the anxiety and confusion often associated with tax preparation.

TurboTax’s Personalized Interview Process for Seamless Tax Filing

At the core of TurboTax’s effectiveness is its comprehensive interview-style process. Users are engaged through a series of personalized questions tailored to their unique financial situation. This dynamic approach ensures that users consider and input all relevant information, including life events, investments, and deductions. TurboTax meticulously addresses various tax scenarios, adapting the tax-filing journey to the individual’s specific circumstances.

Mastering Tax Preparation with Advanced Algorithms and Real-Time Refund Tracking

Precision is paramount in tax preparation, and TurboTax achieves this through its advanced algorithms. These algorithms are not only accurate but are also continuously updated to reflect the latest tax laws and regulations. This real-time integration ensures that TurboTax users stay informed and ahead in a landscape where tax regulations are subject to frequent updates, reducing the risk of errors and providing users with confidence in the accuracy of their calculations.

Understanding the anticipation surrounding tax refunds, TurboTax provides a real-time tracking feature. Users can monitor the status of their refund as it progresses through the IRS system. This feature not only provides transparency but also eliminates the uncertainty associated with the often anxious waiting period for tax refunds.

TurboTax’s Inclusive Guidance for Diverse Tax Scenarios

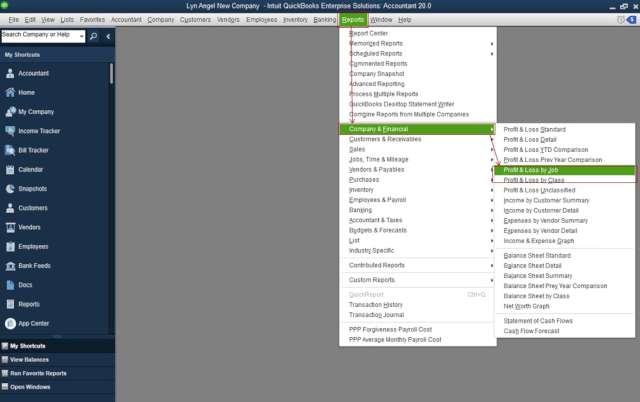

TurboTax is designed to cater to a wide range of financial scenarios. Whether an individual is self-employed, has rental properties, or possesses multiple sources of income, TurboTax offers step-by-step guidance. The platform ensures that users can navigate through and take advantage of all applicable deductions and credits, addressing the complexity of diverse financial portfolios.

TurboTax as Your Comprehensive Financial Knowledge Hub with Expert Support

TurboTax goes beyond being a mere tool; it is an educational resource. The platform provides informative articles, video tutorials, and in-product guidance that empower users with a deeper understanding of tax laws. Additionally, TurboTax offers robust customer support through various channels, including live chat and phone support. This ensures users have access to assistance when needed, fostering a sense of confidence in tackling any tax-related queries or concerns.

TurboTax’s Time-Saving Approach to Tax Preparation and Tailored Financial Solutions.

Beyond its capacity to handle complex tax scenarios, TurboTax focuses on optimizing the efficiency of the tax preparation process. By streamlining the user experience, TurboTax saves users valuable time, allowing them to concentrate on other aspects of their lives. The platform offers various pricing plans, providing cost-effective solutions for a variety of tax-filing needs and ensuring that individuals have access to a tailored approach that suits their specific financial situation.

In conclusion, TurboTax not only simplifies but redefines the tax declaration process for individuals. Its user-friendly interface, comprehensive interview process, accuracy, real-time tracking, adaptability, educational resources, and efficiency collectively contribute to a user experience that transcends traditional tax preparation. TurboTax becomes more than just software; it transforms into a trusted ally, guiding individuals with confidence and ease through the complexities of tax season.